- Community Home

- Knowledge Base

- Understanding ACH Returns - Part 1

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

on

12-02-2022

11:38 AM

- edited on

12-02-2022

12:35 PM

by

ColeCallahan

![]()

The Difference Between Returns, Disputes and Chargebacks

“Disputes” and “chargebacks” are terms heavily used in the card industry. Typically, a consumer would need to submit a dispute or chargeback claim and your card issuer (i.e. banks) would review and investigate the claim before a chargeback is filed. Issuers are obligated to abide by laws like Regulation Z of the Truth in Lending Act.

Unlike card transactions, an ACH payment is not “disputed” nor is it “charged back,” it is simply “returned” based on a set of rules and guidelines established by NACHA, the governing body of the ACH network.

What is an ACH return?

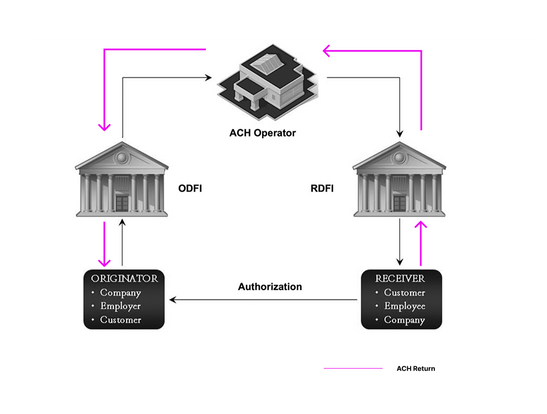

An ACH return is an entry initiated by the RDFI (Receiving Depository Financial Institution) to return the original ACH entry to the Originator through the ACH Network. For example, if you received $1,000,000 from an unrecognized source, you could contact your bank (RDFI) to return the money to the originator. Similarly, if your $100 was taken out of your account but you don’t recognize the debit transaction, you can contact your bank to return the debit transaction. It is important to note that ACH returns must be sent within time frames established by NACHA rules. We will discuss this next in more detail.

How does ACH return work?

- The RDFI (Receiving Depository Financial Institution) receives an entry (credit or debit) and moves funds to or from the appropriate account.

- The RDFI returns it to the ODFI (Receiving Depository Financial Institution). Depending on the return scenario, the RDFI has 2 banking days or 60 calendar days to return the transaction.

- The ODFI receives the ACH return and evaluates the return.

- The ODFI either accepts or dishonors (rejects) the return as untimely, containing incorrect information, or other reasons. We will discuss the dishonored return process later.

- If the ODFI dishonors a return, the RDFI either accepts the dishonored return, contests the dishonored return, or corrects the return.

Note that the sequence above can take place only once; there is no further recourse available to the parties within the ACH Network. Any disagreement beyond this point must be handled outside the ACH process.

How soon should I return a transaction?

The typical timeframe for an RDFI to return a transaction is two banking days. For example, if a transaction has a settlement date of November 1, 2022, a Tuesday, you would need to return this transaction no later than the opening of business on the second banking day following the Settlement Date of the original entry, which is Thursday, November 4, 2022.

In certain cases, for example, when returning a debit entry involving a consumer account, an RDFI has an extended time frame of 60 calendar days to initiate the return. So what are the common return scenarios and the associated time frames? We will discuss this in Understanding ACH Returns - Part 2. Stay tuned!