- Community Home

- Developer Blogs

- Creating a Risk-Aware Card Program

- Subscribe to RSS Feed

- Mark as New

- Mark as Read

- Bookmark

- Subscribe

- Printer Friendly Page

- Report Inappropriate Content

Avid readers of my publications might recall my love of music and the Canadian power-trio Rush. When I focus on the recently-departed drummer of the band, I wonder “How did Neil Peart comprise solos, drum fills, and lyrics so melodically?”

Then, I realized that Neil based his goals on a concise Jonathan Swift quote:

“Vision is the art of seeing what is invisible to others.”

Neil’s vision ultimately led to his success in becoming an inspiration for drummers (and air-drummers) around the globe for several decades. Myself included.

The reality is that Neil faced a mountain of challenges between his origin and the pinnacle of his success. To say the risk of failure was high is definitely an understatement.

Technology is no different.

Artists exist in technology – bringing forth ideas that are invisible to others – with a goal to see their vision become an accepted reality. Instead of musical instruments, they rely on a different set of tooling to help them hone and strengthen their ideas.

One area of concern for me is mitigating risks and satisfying compliance needs with financial transactions. This is important because the failure to address these items has an impact on an entity's bottom line.

For this publication, I thought it would be neat to explore the vision of creating a risk-aware card program and how to leverage existing tools to mitigate risk – since my personal mission statement is laser-focused on leveraging products and services along the way.

AdvoCard Example

Consider a fictional company called AdvoCard, which helps organizations grow their exposure while meeting the common need of making daily purchases. One example might be the Down Syndrome AdvoCard, where a portion of each purchase is donated to Down Syndrome Indiana (DSI), a local group that has provided personal assistance to our family.

Below, is an example of the DSI AdvoCard credit card:

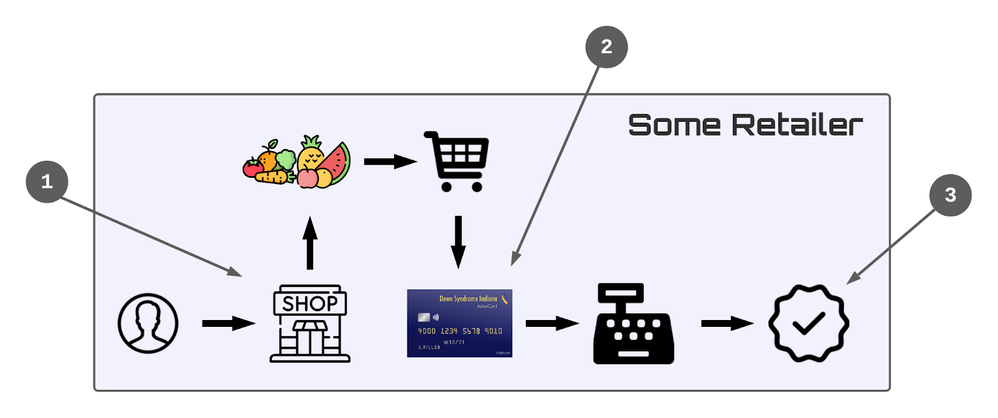

Using an AdvoCard for payment follows the same flow as any other credit card:

- Customer enters a retail establishment to buy groceries.

- Customer provides DSI AdvoCard credit card for the source of purchase.

- Customer departs retailer with groceries in hand.

Unfortunately, the team at AdvoCard faces some challenges if it wants to compete in the card program space:

- Understanding the risk behind each customer’s application for an AdvoCard request

- Knowing whether the customer is legitimate when purchases are being made

- Handling common requests like dispute resolution

While AdvoCard was founded on the principle of providing donation assistance for non-profit groups, they are certainly not immune to being the target of attack from those seeking personal gain through illegal means.

Fortunately, this is where a service like Marqeta’s RiskControl can assist.

Where Marqeta’s RiskControl Portfolio Adds Value

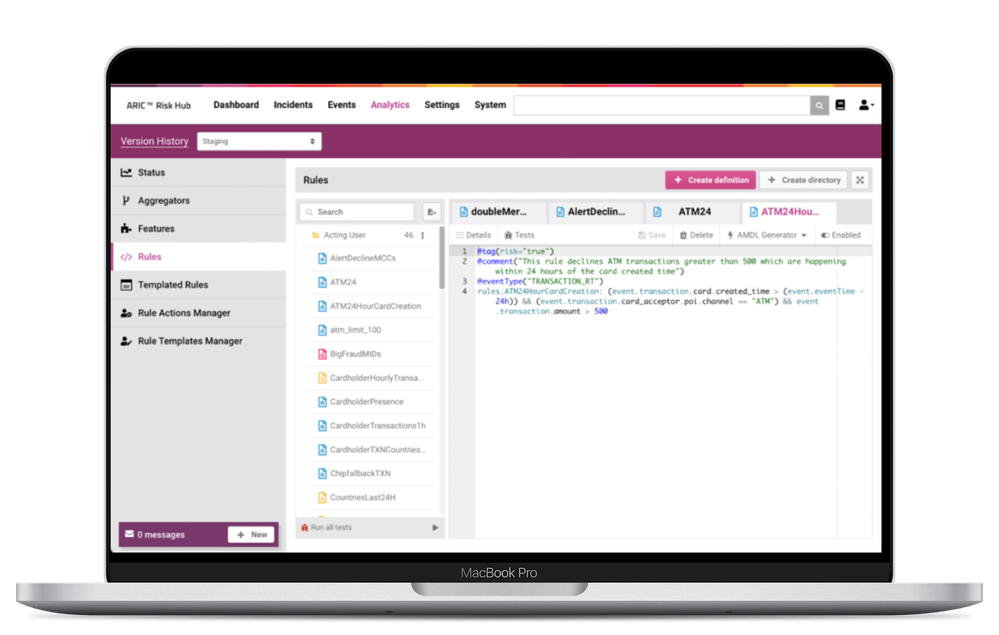

Marqeta has created a portfolio called RiskControl, which can be included in the card program implementation. The RiskControl solution provides the following benefits:

- KYC (compliance, fraud mitigation) for onboarding new customers and cardholders.

- 3D Secure (3DS) regulatory compliance tool / fraud mitigation for secure ecommerce and online checkout.

- Real-Time Decisioning product: per-transaction scoring and rules system that allows customers to be granular about approval controls.

- Leverages Visa and Mastercard risk scores.

- Introduces 350+ attributes to set fine-tuned controls around transaction approval.

- Included in the authorization flow for decisioning (approve or decline).

- Dispute resolution and chargebacks for situations where a cardholder challenges a transaction.

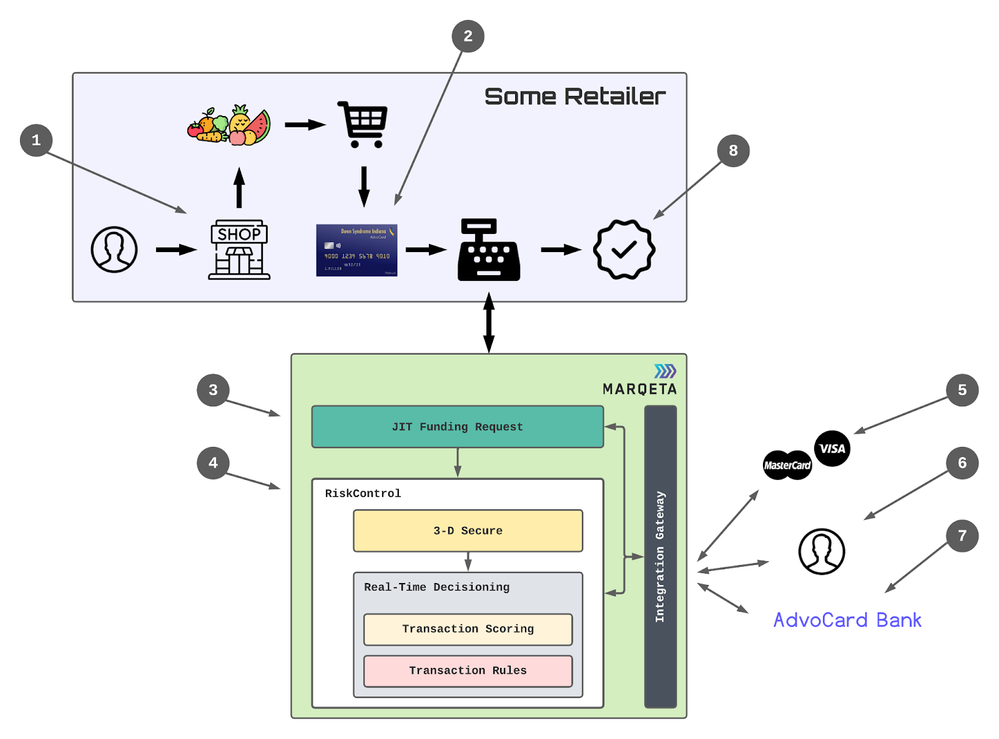

From an orchestration perspective, RiskControl becomes a part of the transaction flow when Marqeta receives the authorization request and works in tandem with the payment solution, adding the appropriate rules logic after receiving a just-in-time (JIT) Funding request.

Now, when we put things together with the original illustration, the implementation design looks like this:

- Customer enters a retail establishment to buy groceries.

- Customer provides DSI AdvoCard credit card for the source of purchase.

- JIT funding request made as a result of Marqeta payment solution.

- Marqeta Real-Time Decisioning logic is evaluated and executed:

- Transaction scoring is processed.

- Transaction rules are evaluated and processed.

- Marqeta RiskControl integrates with Visa/Mastercard APIs for risk scores.

- Optionally, for an online purchase, the customer may be asked to validate their identity and confirm the transaction.

- The transaction utilizes the AdvoCard Bank platform to handle the funding request.

- Customer departs retailer with groceries in hand.

To AdvoCard, many risk mitigation strategies can be implemented, customized down to the cardholder level. In the event that an unexpected transaction occurs, the cardholder contacts the AdvoCard team, who can use the built-in dispute resolution module within RiskControl.

Conclusion

Visionaries have driven our world, resulting in a greater good for all of us. As an example, Neil Peart’s contributions to music helped shape me into the person I am today.

New artists will continue to pave new paths, just as new technologies emerge to provide the tooling to help dreams solidify and succeed.

For technologists, I have been focused on the following mission statement, which I feel can apply to any IT professional:

“Focus your time on delivering features/functionality that extends the value of your intellectual property. Leverage frameworks, products, and services for everything else.”

- J. Vester

This example probably adheres to my mission statement more than any publication I have written.

- Marqeta RiskControl mitigates challenges related to compliance, security, and risk.

- RiskControl goes a step further in its ability to customize the approval process down to the customer level.

- RiskControl provides the solution owner with all the necessary aspects required in an easy-to-use interface for items like dispute handling.

If you want to dive into either of the technologies noted above, you can get started for free using the following link:

Have a really great day!

Have questions or thoughts? Reply to this blog and let us know.

You must be a registered user to add a comment. If you've already registered, sign in. Otherwise, register and sign in.

- Build a Branded Consumer Credit Card on Marqeta's Platform to Fuel Loyalty in Developer Blogs

- Introducing the Marqeta Docs AI Chatbot: What it means for Developers in Developer Blogs

- Introducing Simulations 2.0 in Developer Blogs

- Building a Java Payment App with Marqeta in Developer Blogs

- DevOps Best Practices for FinTechs in Developer Blogs